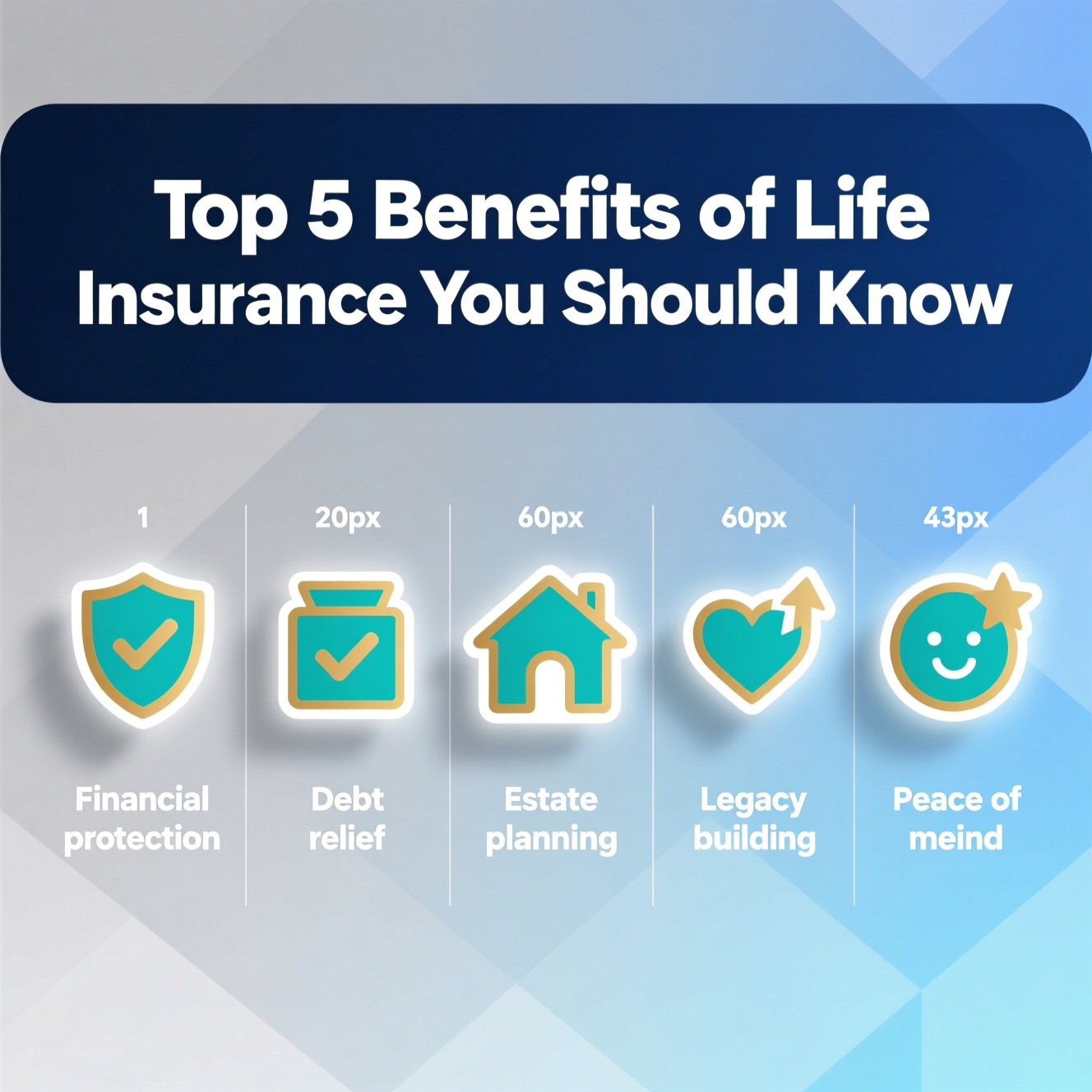

Life is full of uncertainties, and planning for the future is essential. One of the most important financial tools for ensuring stability is life insurance. While many people see it simply as a safety net, the benefits of life insurance go far beyond just paying a lump sum to your family. Understanding these advantages can help you make informed decisions and secure your family’s future.

1. Provides Financial Security for Your Loved Ones

The primary purpose of life insurance is to protect your family financially in the event of your death. If you are the main breadwinner, life insurance ensures that your family can continue to meet daily expenses, pay bills, and maintain their lifestyle.

With proper coverage, your loved ones won’t face financial hardship while coping with the emotional loss of a family member. This peace of mind is invaluable and often the most important benefit of all.

2. Covers Outstanding Debts and Loans

Many families struggle to pay off debts after losing a loved one. Life insurance can cover outstanding loans, credit card bills, or a mortgage. This ensures that your family doesn’t inherit financial burdens along with grief.

For example, if you have a home loan or personal loan, the insurance payout can settle these debts, protecting your family’s assets and preventing them from having to sell property or take on additional loans.

3. Secures Your Children’s Education

Education is one of the biggest investments in a child’s future. Life insurance helps ensure that your children can continue their education uninterrupted, even if you are no longer there to provide for them.

By planning early, parents can choose policies that include educational benefits or accumulate cash value over time, which can later be used to fund college tuition or vocational training.

4. Serves as a Savings and Investment Tool

Some life insurance policies, such as whole life or universal life insurance, combine protection with savings or investment components. These policies accumulate cash value over time, which can be borrowed against or withdrawn in the future.

This means that your life insurance policy not only protects your family but also acts as a financial asset. It can be used for major expenses, emergency funds, or retirement planning, adding another layer of financial security.

5. Offers Tax Benefits

In many countries, life insurance premiums and payouts come with tax advantages. For instance, in Sri Lanka, policyholders may enjoy tax exemptions on certain life insurance premiums, and the death benefit may be tax-free for beneficiaries.

This makes life insurance not just a protective measure but also a strategic financial planning tool. Properly structured policies can reduce your tax burden while providing long-term benefits.

Additional Advantages of Life Insurance

- Flexibility: Policies can be customized with riders for critical illness, disability, or accidental death.

- Peace of Mind: Knowing that your family is protected allows you to focus on your career and personal goals without constant worry.

- Financial Planning: Life insurance encourages disciplined savings and long-term financial thinking.

Choosing the Right Life Insurance

To maximize the benefits of life insurance, consider the following tips:

- Evaluate your family’s financial needs and future goals.

- Compare different types of policies—term, whole, and universal life insurance.

- Consider the premium amount and ensure it fits your budget.

- Choose a reputable insurance company with a strong claim settlement history.

- Review your policy periodically to adjust coverage as your financial situation changes.